22 Mar 2025

Options Terminology

In our previous lesson, we discussed the potential risks associated with trading options. It's essential to be cautious as one can risk losing their entire investment on any given trade. However, options don't have to be intimidating. In fact, there are various strategies that enable better risk control compared to equities. Before delving further into options trading, it's important to familiarize yourself with some basic terminology:

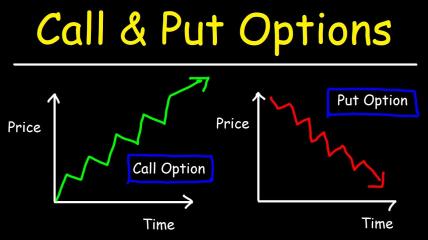

1. Put: The right, but not the obligation, to sell the underlying asset at a specific price by a particular date.

2. Call: The right, but not the obligation, to buy the underlying asset at a specific price by a specific date.

3. Contract: The basic unit of an option, representing the right to buy or sell 100 shares of the underlying security.

4. Long: The act of buying or owning a contract. Also known as "holding."

5. Short: The act of selling a contract. Also known as "writing."

6. Underlying: The instrument upon which the option contract is based, such as a stock, index, or ETF.

7. Strike: The price at which the option contract allows the holder to buy or sell the underlying asset.

8. Exercise: Refers to either the strike price or the act of fulfilling an option contract (buying or selling the underlying asset).

9. Premium: The cost of buying an option or the amount received from selling an option.

10. Intrinsic Value: The inherent value of the option, calculated by subtracting the strike price from the current underlying asset price. It exists only when the option is in-the-money.

11. Extrinsic Value: The value of an option above its intrinsic value, often referred to as time value.

12. In-the-money (ITM): An option that has intrinsic value.

13. At-the-money (ATM): When the strike price and the market price of the underlying asset are the same. ATM options consist solely of time value.

14. Out-of-the-money (OTM): A call option is OTM when its strike price is higher than the current market value of the underlying asset. A put option is OTM when its strike price is lower than the current market value of the underlying asset. These options only have time value.

15. Expiration: The date on which the option contract expires and becomes invalid.

16. The Greeks: Variables that measure specific factors influencing the price of an option. These will be covered in more detail later in the course.

17. Holder: The buyer or owner of an option.

18. Writer: The seller of an option.

19. Hedge: A strategy used to protect a position, similar to an insurance policy.

20. Historical Volatility: A measure of the dispersion of returns around the mean.

21. Implied Volatility: The market's estimation of future volatility, based on supply and demand.

22. Synthetic: Utilizing options to replicate the risk/reward profile of a stock position.

23. Buy/Write: Simultaneously buying a stock and writing a call option against it.

24. Assignment: If an option expires with at least one penny of intrinsic value, the holder will be assigned 100 shares for each option. The option buyer has the right to take assignment at any time before expiration, whereas the option seller can be obligated to assignment at any time.

25. Front Month: Refers to the nearest-term option contract.

26. Calendar Spread: Also known as a time spread, it involves simultaneously buying and selling two options of the same type on the same underlying asset but with different expiration months.

27. Class: Refers to the set of all options of a given type (puts or calls).

28. Long Vertical Spread: A strategy created by simultaneously buying and selling similar options on the same underlying with the same expiration but different strike prices.

29. Long Straddle: An option strategy involving buying one at-the-money put and one at-the-money call on the same underlying, both expiring in the same month.

30. Long Strangle: An option strategy involving buying one out-of-the-money put and one out-of-the-money call on the same underlying, expiring in the same month.

31. Butterfly Spread: An option strategy that combines two vertical spreads on the same underlying, with one spread being long and the other short.

32. Credit: The amount of premium received when selling an option.

33. Debit: The amount of premium paid when buying an option.

34. Near-term: An option contract expiring within 1 to 3 months.

35. Mid-term: An option contract expiring within 4 to 6 months.

36. Far-term: An option contract expiring within 7 to 12 months.

37. LEAPS: Options contracts expiring more than one year in the future, known as Long-term Equity Anticipation Securities.

As we progress through the course, you'll become more familiar with these terms. Feel free to revisit them whenever needed.