18 Mar 2025

Lesson 1: An introduction to Options trading

I have previously shared my thoughts on buying options in my personal account, whether to capitalize on special situations or hedge positions in my long portfolio. Many of have expressed interest in learning more about my philosophy regarding options trading.

Now, I would like to provide you with the same tools I use to execute more complex trades and help you reach a level of comfort in trading options.

The following series is designed to offer basic education for those who are interested in incorporating options into their overall investment strategy.

However, it's essential to acknowledge that options are not suitable for everyone.

Before we delve into the lessons, I must emphasize that options carry inherent risks, and there is a possibility of losing 100% or more of your investment.

Here's an example to illustrate this point:

Suppose you purchase 100 shares of XYZ at $10 per share, with the expectation that its price will rise to $12 within a month, resulting in a $200 profit.

If the price of XYZ falls to $9.50, you can sell the stock and limit your loss to $50. Even if XYZ reaches only $11 at the end of the expected holding period, you still make a $100 profit ($1 per share or a 10% gain on the trade).

However, when buying an option, you need to be correct about the direction, price, time, and volatility to make a profit. Unlike stocks, options have multiple factors affecting their price, making them more complex.

For instance, let's say you buy an XYZ $12 call option (we'll explain "call option" soon) that expires in 30 days when the underlying stock is trading at $12.

Here are some possible outcomes:

If XYZ's price drops to $9.50, your $12 call option may lose a significant portion of its value.

If, on the expiration date, XYZ is not above $12, you will lose the entire cost of buying the option. Keep in mind that options are time-sensitive assets.

In other words, when buying options, you are essentially playing against the clock. You are predicting that the stock's price will reach a certain level by a specified date.

Options may be difficult for inexperienced traders and investors to comprehend, and they do come with inherent risks. However, just like a chef's knife can be a valuable tool in the hands of a skilled cook, options can be a crucial part of an investment toolkit for knowledgeable traders.

The screenshot provided displays an actual trade I made, showcasing the potential profitability of trading options. To further enhance your understanding and solidify the concepts I will be teaching, I strongly recommend downloading the booklet "Characteristics and Risks of Standardized Options" published by the CBOE.

Before proceeding to open an options trading account, it is important to consider the concept of suitability. Brokerage firms impose four levels of Option Approval, which determine the type of account you can have.

In general, options should only be traded with risk capital—funds that you can afford to lose. Although no one enters trades with the intention of losing money, it is crucial to acknowledge that trading options involves speculation rather than traditional investment.

Here are the four levels of Option Approval your broker may impose on your account (we will cover more strategies in detail later, so you may want to revisit this section once you are familiar with them):

1. Approval Level One allows you to buy cash-secured puts (not bought on margin) and write covered calls. You must already have common stocks in your account to qualify for this level, and the options you can buy or sell are limited to the stocks you currently own. The number of contracts you can trade is restricted to your long position of stock (e.g., if you own 100 shares of XYZ, you can only buy or sell 1 XYZ put or call at a time).

2. Approval Level Two grants you Level One privileges and enables you to buy any number of puts or calls that you desire (as long as you have the cash or margin buying power), including options on stocks, ETFs, or indexes.

3. Approval Level Three encompasses everything in Level Two and allows you to trade spreads. You can enter into a short spread if you have sufficient liquidity but cannot engage in naked shorting (uncovered shorting).

4. Approval Level Four is the highest level of option approval. It grants the same privileges as Level Three and permits the writing of naked calls and naked puts.

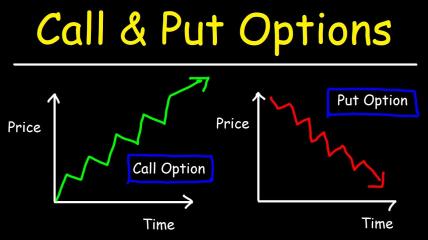

In the next lesson, I will introduce the basic uses of puts and calls, explaining what they are and how they can be utilized to achieve various investment objectives.